The latest rate on a 30-year fixed-rate mortgage is 8.578% ⇓ 0.037%.Almost all other loan types had lower average rates as well, with the exception of 5/6 and 10/6 adjustable-rate mortgages. The rate on a 30-year foxed-rate mortgage averaged 8.578%, lower than the previous day. Money's average mortgage rates for October 6, 2023 Borrowers with lower credit scores will generally be offered higher rates. The average rate represents roughly the rate a borrower with strong credit and a 20% down payment can expect to see when applying for a mortgage right now.

#CAL MORTGAGE RATES MAC#

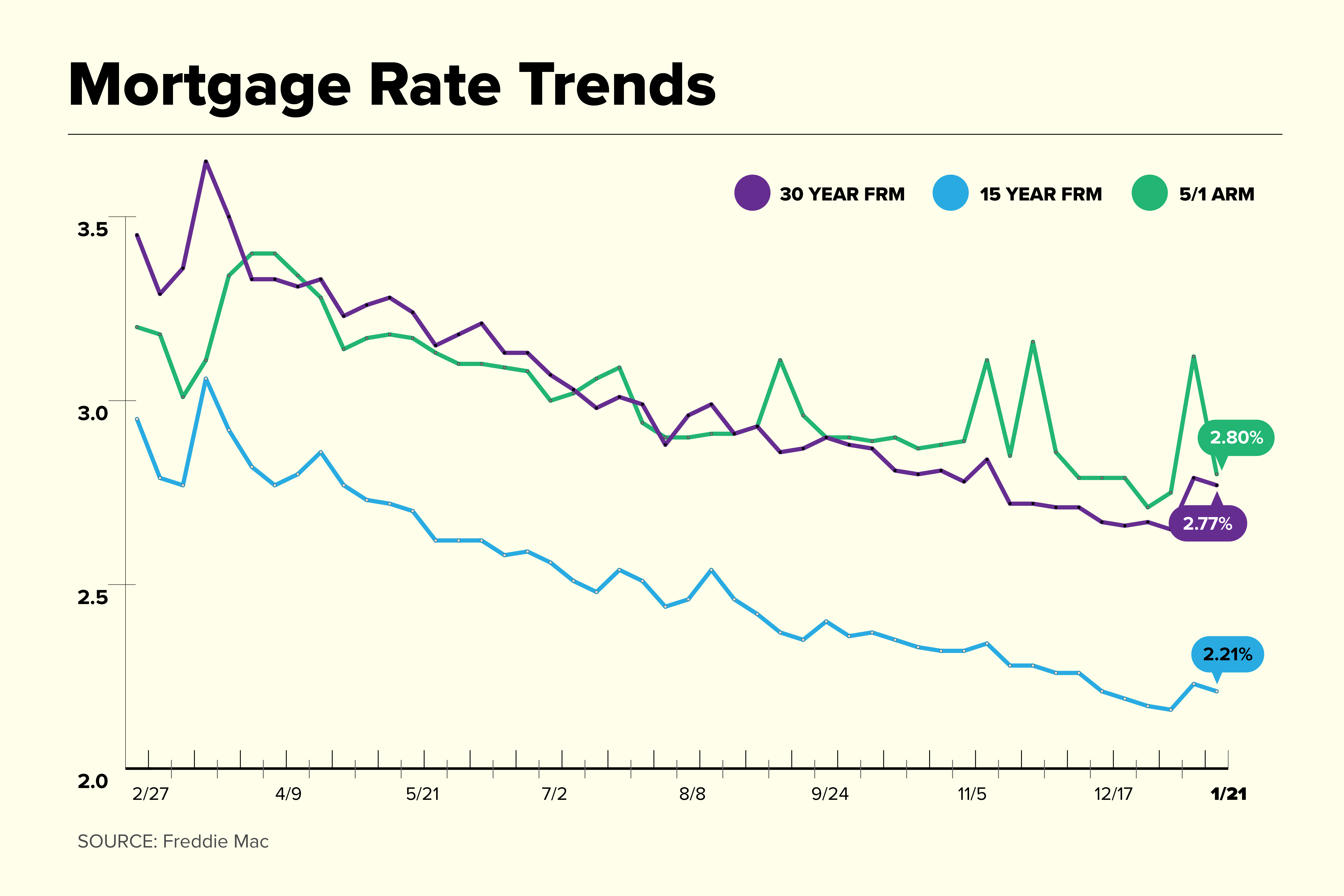

A year ago, the 15-year rate averaged 5.90%.įor its weekly rate analysis, Freddie Mac looks at rates offered for the week ending each Thursday. The current rate for a 15-year fixed-rate mortgage is 6.78%, moving up by 0.06 percentage points compared to a week ago.Last year, the 30-year rate averaged 6.66%. The current rate for a 30-year fixed-rate mortgage is 7.49%, an increase of 0.18 percentage points over the past week.Louis, Missouri are also seeing dramatic price drops. Memphis, Tennessee tops the list, with nearly 23% of listed home buyers reducing their asking price. Price cuts are more common in 14 of the largest metros in the U.S., according to a report by.But this year, the cool down is chillier than normal: More home sellers are cutting their prices in a bid to attract still-active buyers, according to a report by brokerage Redfin. We've reached the time of year when the housing market typically starts to slow down (what with school starting and temperatures dropping).Here's a round-up of the latest news in housing: What's been happening in the housing market Difference between APR and interest rate.What is a good interest rate on a mortgage?.What credit score do mortgage lenders use?.How are mortgage rates impacting home sales?.Use Money's mortgage calculator to get an estimate of your monthly payment, taking different rate scenarios into consideration. Homeowners considering a mortgage refinance should consider our list of the Best Mortgage Refinance Companies.) (Money's list of the Best Mortgage Lenders is a good place to start. If you're offered a higher rate than expected, make sure to ask why and compare offers from multiple lenders. The average rate for a 15-year fixed-rate mortgage increased to 6.78%, up by 0.06 percentage points over the past week. As a result, we're seeing "the highest mortgage rates in a generation," said Sam Khater, chief economist at Freddie Mac, in a statement. Rates have surged over the past month due to a combination of factors, including changes in inflation, the continued strength of the job market and uncertainty over the Federal Reserve's next move.

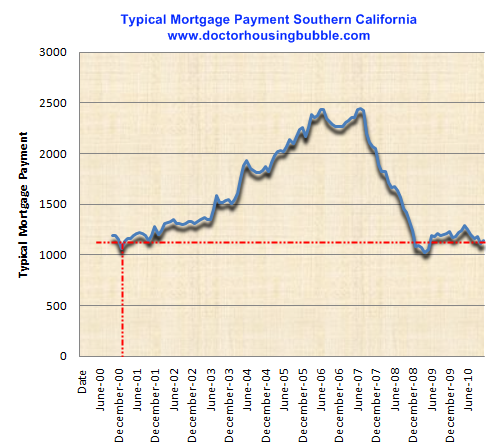

The last time the 30-year rate was this high was December 2000. Week-over-week, that represents a change of 0.18 percentage points.

The average rate for a 30-year fixed-rate loan, the most common type of mortgage among American homebuyers, increased to 7.49% for the week ending October 5, according to Freddie Mac. Rates climbed even higher this week, setting a new high for the year.

0 kommentar(er)

0 kommentar(er)